Important Notice: CRA Transitioning to Online Mail for Businesses in Spring 2025

Canada Revenue Agency (CRA)

Canada Entrepreneurs’ Incentive: A Boost for Innovation and Growth

In a bid to foster economic growth and innovation, the Canadian government has introduced a new “Entrepreneurs' Incentive” as part of Budget 2024. This initiative aims to provide additional support to entrepreneurs, helping them to scale up their businesses and drive Canada's economic progress.

Navigating 2025 Tax Changes: What You Need to Know

As we step into 2025, it’s time to review the key tax changes for the year to help individuals and businesses plan their finances effectively. This summary highlights the most significant updates in federal and provincial tax policies, offering insights to optimize financial strategies and navigate the evolving tax landscape.

2025 Automobile Deduction Limits and Expense Benefit Rates for Businesses

the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit rates that will apply in 2025.

Navigating Canada’s New Capital Gains Inclusion Rate: What You Need to Know

In a move to create a more equitable tax system, the Canadian government has introduced significant changes to the Capital Gains Inclusion Rate, effective June 25, 2024. This revision, announced in the 2024 budget, impacts how capital gains are taxed and alters the treatment of capital losses.

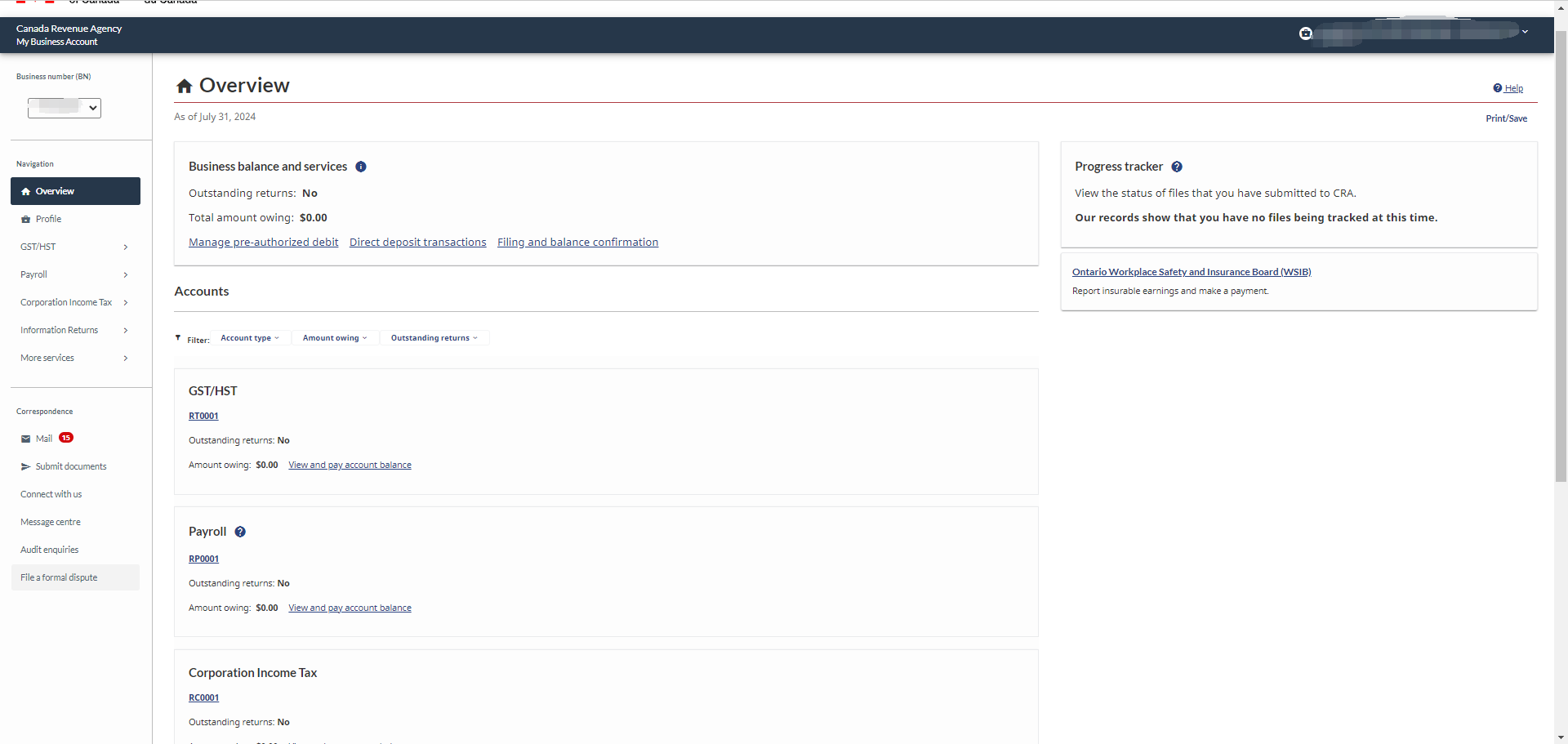

How to Register for a CRA My Business Account

Registering for a CRA My Business Account is an essential step for Canadian business owners to manage their tax affairs efficiently. This online service provided by the Canada Revenue Agency (CRA) allows business owners to have 24/7 access to various tax information and services securely. My Business Account is also mandatory in order to authorize representatives such as an accountant or manager. CRA online portal allows you to perform various transactions, such as making payments, arranging Pre-Authorized Debit (PAD), updating direct deposit information, submitting supporting documents.

Understanding the Enhanced CPP: Key Changes and Impacts in 2024

The Canada Pension Plan (CPP) is a monthly tax benefit designed to provide partial income replacement for retirees. The purpose of the CPP is to help Canadians maintain a certain standard of living after retirement. The income for the CPP comes from contributions made by employers and employees, as well as investment earnings. Both the contribution amounts and benefits of the CPP are adjusted according to the average wage and price levels in Canada.

What’s New in Taxes? Understanding 2024’s Key Tax Changes

The past year has been challenging for Canada in terms of macroeconomics, the business environment for small enterprises, and household financial arrangements. These challenges persist into 2024, and the new year continues to be filled with uncertainties. As usual, let's briefly summarize the tax changes for 2024 to help individuals and businesses make appropriate financial plans.

GST/HST Quick Method-The Ultimate Guide for Small Business Owners

The GST/HST Quick Method is a simplified tax calculation method designed for small business owners and self-employed individuals. It helps them easily calculate and remit Goods and Services Tax (GST) or Harmonized Sales Tax (HST). In this article, we will use an example to explain the HST Quick Method and assist small business owners in better understanding it.

The Digital Marketing Blueprint for Small Business Success

In an interconnected world, small companies must rely on digital marketing to reach and engage with customers. It may assist small businesses in increasing their internet visibility, generating leads, and eventually driving more sales. In this post, we will discuss some crucial aspects of digital marketing that small businesses should concentrate on to succeed.

- 1

- 2