Understanding RRSP Withdrawals: When It Makes Sense to Take Money Out Early

A Registered Retirement Savings Plan (RRSP) is a popular way for Canadians to save for retirement while getting a tax break. When you put money into an RRSP, it lowers the income you pay taxes on that year. For example, if you earn $50,000 and contribute $5,000 to your RRSP, you’re only taxed on $45,000. The catch? When you take money out, it’s treated as income, and you pay tax on it based on your tax rate at that time. Most people wait until retirement to withdraw, but there are smart reasons to take money out earlier. Let’s explore five situations where this could work for you, with more details to help you understand how it all fits together.

Important Notice: CRA Transitioning to Online Mail for Businesses in Spring 2025

Canada Revenue Agency (CRA)

Understanding the Municipal Non-Resident Speculation Tax (MNRST) in Toronto

Purpose and Tax Rate

Canada Entrepreneurs’ Incentive: A Boost for Innovation and Growth

In a bid to foster economic growth and innovation, the Canadian government has introduced a new “Entrepreneurs' Incentive” as part of Budget 2024. This initiative aims to provide additional support to entrepreneurs, helping them to scale up their businesses and drive Canada's economic progress.

Navigating 2025 Tax Changes: What You Need to Know

As we step into 2025, it’s time to review the key tax changes for the year to help individuals and businesses plan their finances effectively. This summary highlights the most significant updates in federal and provincial tax policies, offering insights to optimize financial strategies and navigate the evolving tax landscape.

2025 Automobile Deduction Limits and Expense Benefit Rates for Businesses

the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit rates that will apply in 2025.

Principal Residence Series (Part 2) – Converting a Principal Residence into a Rental Property

When selling a property, it is generally known that capital gains tax needs to be calculated based on the property's use, and the corresponding tax must be paid. If the property is a principal residence, the Principal Residence Exemption (PRE) can be used to exempt some or all of the capital gains tax. However, many people are unaware of the provisions of Section 45(1) of the Income Tax Act, which states that when there is a change in the use of a property, it is deemed to be disposed of at fair market value. A change in use refers to converting a property used for personal purposes into one used for income-generating purposes, or vice versa. In simple terms, this means that if you previously owned a principal residence or a vacation home that you used solely for personal enjoyment (e.g., living or vacationing), and then decided to use that property to generate income, whether through long-term rental or running a Airbnb, the property is deemed to have been sold at its fair market value at the time of the change in use. The same rule applies if you convert a rental property into one for personal use. The Income Tax Act also provides two sister provisions, Sections 45(2) and 45(3), which allow taxpayers to make elections that, if used correctly, can effectively avoid capital gains tax.

Navigating Canada’s New Capital Gains Inclusion Rate: What You Need to Know

In a move to create a more equitable tax system, the Canadian government has introduced significant changes to the Capital Gains Inclusion Rate, effective June 25, 2024. This revision, announced in the 2024 budget, impacts how capital gains are taxed and alters the treatment of capital losses.

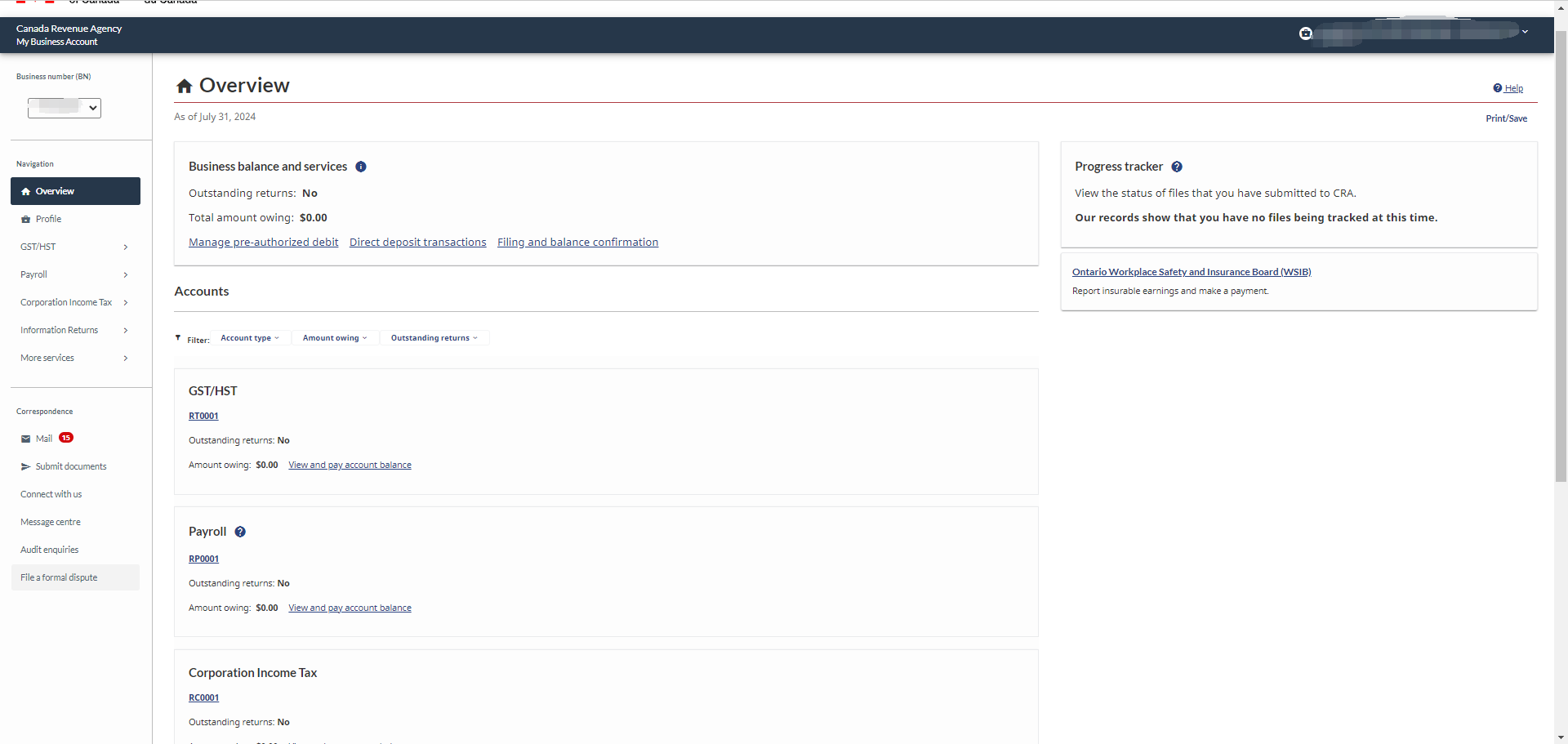

How to Register for a CRA My Business Account

Registering for a CRA My Business Account is an essential step for Canadian business owners to manage their tax affairs efficiently. This online service provided by the Canada Revenue Agency (CRA) allows business owners to have 24/7 access to various tax information and services securely. My Business Account is also mandatory in order to authorize representatives such as an accountant or manager. CRA online portal allows you to perform various transactions, such as making payments, arranging Pre-Authorized Debit (PAD), updating direct deposit information, submitting supporting documents.