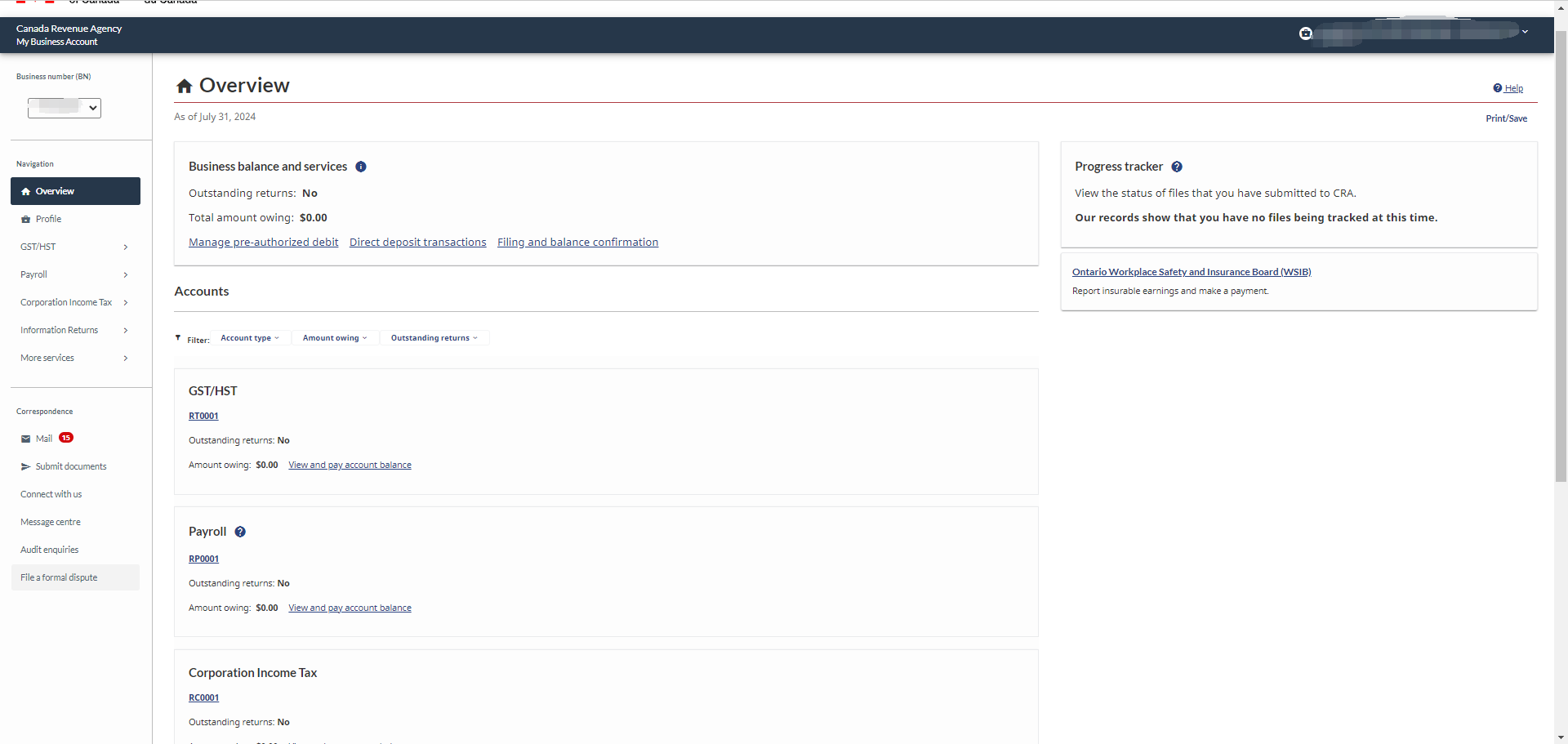

Registering for a CRA My Business Account is an essential step for Canadian business owners to manage their tax affairs efficiently. This online service provided by the Canada Revenue Agency (CRA) allows business owners to have 24/7 access to various tax information and services securely. My Business Account is also mandatory in order to authorize representatives such as an accountant or manager. CRA online portal allows you to perform various transactions, such as making payments, arranging Pre-Authorized Debit (PAD), updating direct deposit information, submitting supporting documents.

If you already have an existing CRA My Account, you can use your My Account user ID and password to log in to My Business Account. All businesses under your name should be listed in My Business Account. If you can’t find the business you want to access, you will need to contact the CRA to link your SIN to your business number. Here are two ways to contact the CRA:

1) By phone: If you need to update your information immediately, you can call CRA at 1-800-959-5525 (within Canada and the United States) or at 613-940-8497 (from outside Canada and the United States). Choose option 6 to speak with a CRA agent. Be prepared to answer confidentiality questions, which may include:

- Business number and full legal name of the business

- Business address

- Information regarding recent tax returns filed: For T2 returns, amounts on line 300, line 700, and line 770

- Incorporation details (if no tax return has been filed yet): Date of incorporation, Jurisdiction of incorporation and Corporation number

2) By Mail: You can send a written request to the tax centre, though please note that processing may take 2-4 weeks. The letter should be signed and dated by the owner and must include the following information:

- Business name and business number (one letter can cover all business accounts owned by the same individual)

- SIN, date of birth, address, and phone number

Here’s a step-by-step guide on how to register for a new CRA My Business Account.

Step 1: Gather Required Information

Before you begin the registration process, ensure you have the following information on hand:

- Social Insurance Number (SIN) or Business Number (BN)

- Date of Birth &Postal Code

- Tax Return Information from your most recent income tax and benefit return

Step 2: Visit the CRA Website

Go to the official CRA website and navigate to the “My Business Account” page.

Step 3: Choose Your Login Method

The CRA offers two ways to log in:

CRA Login: If you have previously registered for any CRA services, such as My Account for individuals, you can use the same CRA user ID and password.

Sign-In Partner Login: You can use your online banking credentials from one of the CRA’s Sign-In Partners (e.g., BMO, Scotiabank, TD).

Step 4: Register for a CRA User ID and Password

If you don’t have a CRA user ID and password, you need to register for one. Here’s how:

- Click on the “CRA Register” button on the My Business Account login page.

- Provide Your Personal Information: Enter your SIN, date of birth, postal code, and an amount from a specific line on your income tax return.

- Create a User ID and Password: Follow the prompts to create a secure user ID and password.

- Set Up Security Questions and Answers: These will be used to verify your identity if you need to reset your password or recover your account.

Step 5: Enter Your Access Code

You will receive an access code by mail from the CRA. This code is necessary to complete your registration and activate your account. Once you receive the code:

- Log in to your CRA My Business Account using your user ID and password.

- Enter the Access Code: Follow the instructions to input the access code.

Step 6: Activate Your Account

After entering the access code, your CRA My Business Account will be fully activated. You can now access various tax services and information related to your business.

Registering for a CRA My Business Account is a crucial step in managing your business’s tax obligations efficiently. By following this guide, you can ensure that your registration process is smooth and that you can access and manage your tax information securely. Should you encounter any issues, remember that the CRA provides support to help you link your business accounts properly. Taking these steps will allow you to focus more on growing your business and less on navigating tax complexities.