Claim Work from home exenpeses: The temporary measure for simplified method of home office expenses during the pandemic will not continue in 2023. However, if your company allows you to work from home for more than 50% of the time, you can claim home office expenses when filing taxes. To do so, you need to obtain a T2200 form signed by your employer.

Tax loss selling: Investors with non-registered accounts can sell loss-making stocks, funds, or bonds before year-end to offset capital gains, reducing taxable income. If capital losses exceed gains, they can offset past or future gains. Notably, currency exchange rates can impact gains or losses for foreign stock investments. Investors must be aware of the superficial loss rule, where losses from selling and rebuying the same stock within 30 days are not deductible. This strategy only applies to actual sales, not transfers to RRSP or TFSA accounts. Note that the deadline for tax loss selling is December 27 this year, to ensure completion by December 29.

Alternative Minimum Tax (AMT) : The Alternative Minimum Tax (AMT) in Canada is a method of calculating income tax to prevent high earners from significantly reducing their taxes through deductions like capital gains relief. AMT involves complex calculations, adjusting regular taxable income and limiting exemptions and deductions. The formula is: AMT = 15% * (Adjusted Taxable Income – CAD 40,000) – qualified non-refundable tax credits. If AMT exceeds regular federal income tax, the individual pays AMT instead. The difference is a “temporary” refundable tax payment usable over seven years to offset regular taxes. Major changes to AMT, particularly affecting high earners, are expected from January 1, 2024. 2023 is the last year before these AMT reforms, suggesting strategic financial decisions for high earners to avoid higher AMT next year.

Housing-related tax benefits: the First Home Savings Account (FHSA), introduced in 2023, allowing first-time homebuyers to lower taxable income by contributing up to CAD 8,000 annually. Unused contribution room can be carried forward. The multi-generational home renovation tax credit offers a 15% return on up to CAD 50,000 for creating a secondary living unit for seniors or disabled family members. The Home Accessibility Tax Credit (HATC) provides a rebate on up to CAD 20,000 in renovations for seniors or disabled individuals, equivalent to CAD 3,000 in tax savings. Expenses must be paid by December 31 for claims.

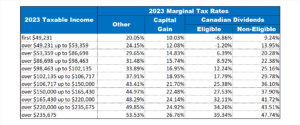

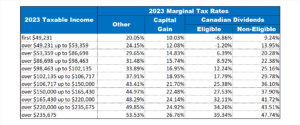

The Ontario tax brackets and rates for 2023 are as follows