As we start the new year of 2023, we say goodbye to the epidemic for good but begin a new year full of uncertainty accompanied by high-interest rates and high inflation. To help individuals and businesses plan their finances, it is helpful to review any changes in taxation for the coming year. It is recommended to seek the advice of an accountant or reliable sources for the most current and accurate information.

- In 2023, the federal basic personal amount (personal tax exemption) will increase to $15,000, which will reduce federal taxes by $90.3. However, for individuals with incomes over $165,430, the additional personal amount (beyond the cost-of-living adjustment) will be reduced, and for those with incomes over $235,675, the additional personal amount will be reduced to zero. The corresponding personal amount for these individuals will be $13,521. In 2023, the personal exemption in Ontario will be $11,865.

- CPP Canada Pension contribution rates will continue to increase. Under the new enhanced CPP reform plan, the CPP contribution rate for individuals and companies will increase from 5.7% in 2022 to 5.95% in 2023. The maximum annual contribution for an individual is $3,754.45 for an average employee, $7,508.90 for a self-employed person, and the corresponding maximum pensionable earning is $66,600.

- In 2023, the EI unemployment insurance premium rate will increase from 1.58% in 2022 to 1.63% in 2023. The maximum annual EI premium will also reach a new high of $ 1,002.45, corresponding to the maximum annual insurable earnings of $ 61,500.

- In 2023, the contribution limit for Tax-Free Savings Accounts (TFSAs) will increase by $ 500 to $ 6,500. The lifetime contribution limit for TFSAs is $ 88,000. The maximum contribution limit for Registered Retirement Savings Plans (RRSPs) in 2023 will be $ 30,780.

- The Climate Action Incentive (CAI) has increased. In Ontario, the CAI has increased to $ 488 for individuals, $ 732 for two-person households, and $ 976 for four-person households. Starting in 2022, the CAI will be paid on a quarterly basis, and taxpayers will receive their first payment for the 2023 tax year in July 2023.

- The federal Residential Anti-Flipping Rules will come into effect in 2023. Any profit from the sale of residential property within 12 months of its purchase will be considered flipping, and the income will be taxed as business income instead of capital gain. The primary residence exemption will not apply in these cases. However, there may be certain exceptions, such as when a family member becomes disabled or dies, a new job is taken, a child is born, or a divorce or separation occurs.

- The Multi-Generation Home Renovation Credit is a tax credit for families who live in multi-generation homes. It is available to families who build a second independent living unit or renovate their existing home for an elderly or disabled family member. The credit allows these families to claim a tax refund of 15% of their qualified home renovation expenses, up to a maximum claim of $ 50,000, which is equivalent to a tax refund of $ 7,500.

- The Tax-Free First Home Savings Account (FHSA) will be available starting January 1, 2023. Similar to a Registered Retirement Savings Plan (RRSP), contributions to an FHSA are tax-deductible. The maximum annual contribution limit for an FHSA is $ 8,000, with a lifetime contribution limit of $ 40,000. For more information about the FHSA, please refer to our previous article on the subject.

- Starting in 2023, the First-Time Home Buyer Tax Credit doubles to $10,000 for the first-time buyer, which is a $1,500 reduction in taxes. No additional application is required for this tax credit, and eligible taxpayers can simply enter the $10,000 amount on tax form Line 31270.

- There are not many changes to small business taxes. The federal small business tax rate for profits under $ 500,000 remains at 9%, and the Ontario small business tax rate is 3.2%. The Ontario combined small business tax rate is 12.2%. Additionally, due to the increase in the Canada Pension Plan (CPP) contribution rate by 0.25%, the employer portion of CPP contributions will also increase. The increase in the CPP contribution rate will result in additional costs for both businesses and individuals. Small business owners may consider increasing dividends to themselves as a means of compensation, but this should be carefully considered based on personal and family circumstances, and it may be advisable to consult a professional for guidance on creating a suitable plan.

- Small businesses that applied for the Canada Emergency Business Account (CEBA) loan during the pandemic need to repay $ 40,000 before December 31, 2023 to receive a $ 20,000 forgiveness benefit.

For taxpayers who received pandemic assistance in 2022, if their income exceeded $38,000 in 2022, they will need to repay a portion of the assistance in 2023. It is expected that the Canada Revenue Agency (CRA) will also increase efforts to recover pandemic assistance that was not eligible in 2023. In addition, starting on January 1, 2023, foreign nationals will be banned from purchasing residential property in Canada for a two-year period. Certain exceptions apply, such as for international students and work permit holders. For more information, you may wish to refer to our article on the subject.

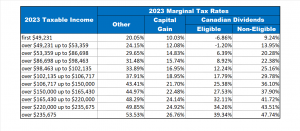

The following chart shows the Ontario personal tax brackets for 2023 for your reference.