In a bid to foster economic growth and innovation, the Canadian government has introduced a new “Entrepreneurs’ Incentive” as part of Budget 2024. This initiative aims to provide additional support to entrepreneurs, helping them to scale up their businesses and drive Canada’s economic progress.

Key Features of the Incentive

- Reduced Capital Gains Tax: The incentive reduces the inclusion rate on eligible capital gains to 33.3%, with a lifetime maximum of $2 million. This means entrepreneurs can retain more of their profits when selling their businesses.

- Increased Lifetime Exemption: Combined with the existing $1.25 million Lifetime Capital Gains Exemption, the total potential exemption reaches $3.25 million. This is set to increase by $200,000 annually until 2034, reaching a maximum of $2 million.

- Expanded Eligibility: The incentive is available to founding investors who own at least 10% of shares in their business and have been actively engaged for at least five years. The government is also considering reducing these ownership and engagement requirements to make the incentive more accessible.

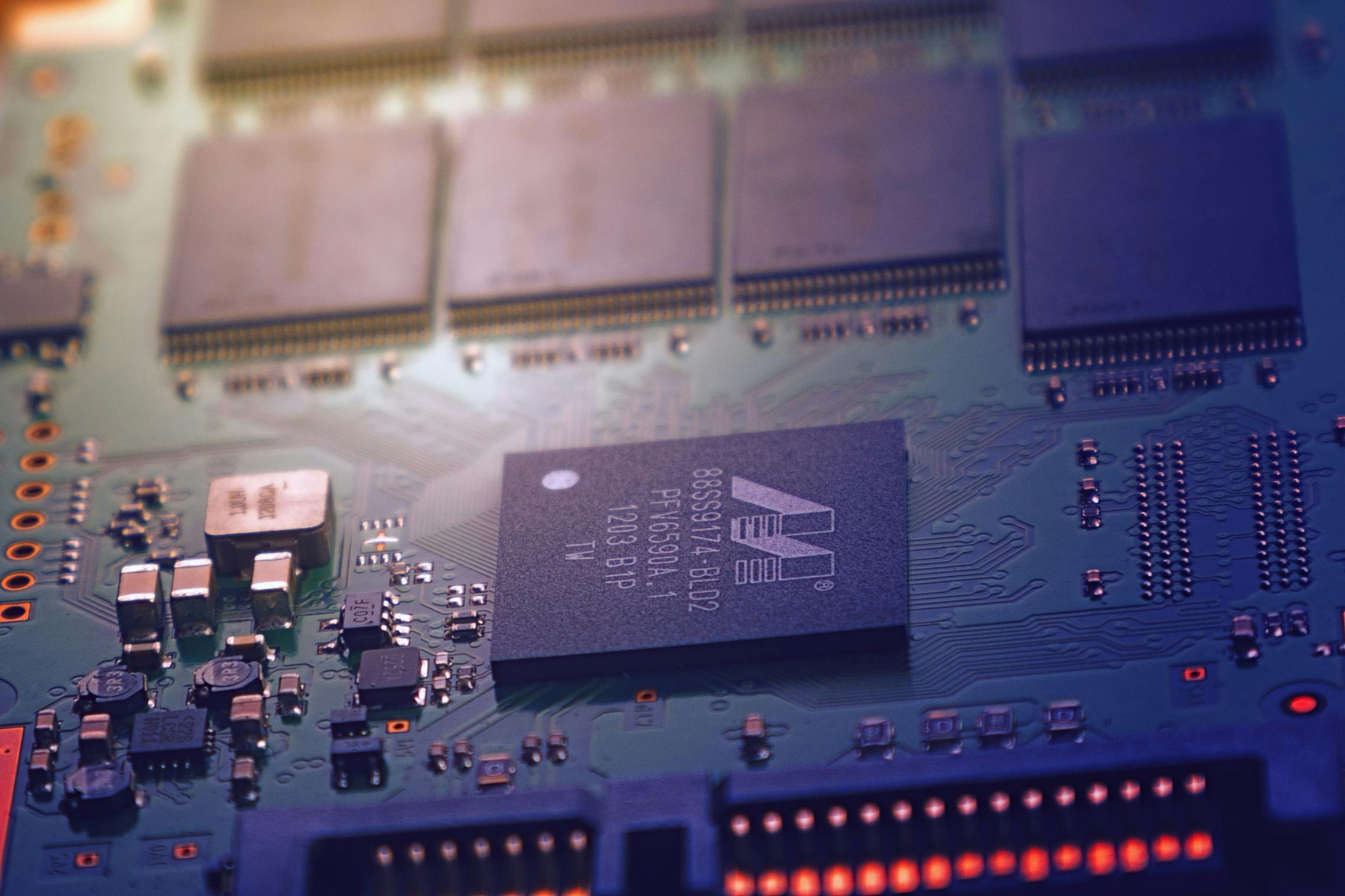

- Focus on Key Sectors: The incentive targets sectors such as technology and manufacturing, encouraging innovation and investment in these critical areas.

Benefits for Entrepreneurs

The Entrepreneurs’ Incentive is designed to provide entrepreneurs with more capital to reinvest in their next ventures, whether it’s starting a new company, investing in a promising startup, or planning for retirement. By reducing the tax burden on capital gains, the government hopes to encourage more entrepreneurs to take risks and innovate, ultimately leading to job creation and economic growth.

Future Outlook

As the incentive rolls out, it is expected to benefit a wide range of small business owners, including farmers and tech innovators. The government’s commitment to supporting entrepreneurs reflects a broader strategy to build a fairer and more prosperous Canada for future generations.

This new initiative is a significant step towards empowering Canadian entrepreneurs and ensuring that their hard work and innovation continue to drive the country’s economic success.